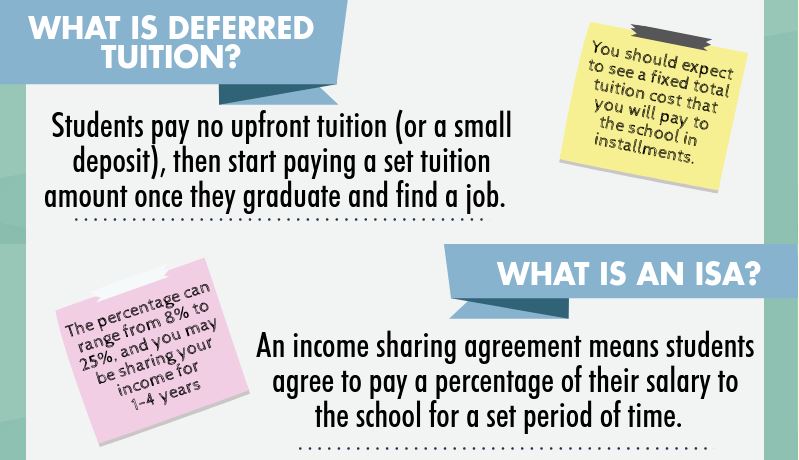

The debilitating nature of the student-debt crisis is giving birth to new options. At first glance, these options can seem new, unique and helpful. However, when you dig a little deeper, you realize that some of these options aren’t all that different from what they are meant to replace. Take, for instance, income sharing agreements. The deal is, the school doesn’t charge you tuition while you’re in school. However, once you graduate and start working, the school takes a fixed percentage cut of your paycheck, over a defined period of time. Does that remind you of something else? Say, a LOAN for instance…?

They’re essentially “I owe you” notes – students sign these notes over to the school. While they’re pegged as a new form of borrowing, the Consumer Financial Protection Bureau, a federal regulatory agency, has deemed the ISA as just another form of student loan. When it’s all said and done you’re still paying your school money, long after you’ve graduated and left campus. That’s no different than a student loan – exactly what got us here to begin with.

Here are a few key characteristics about ISAs:

- Income Share Percentage – this is the agreed upon percentage of your future income that you contractually promise to give to the lender – it can be anywhere between 2% and 10%, depending on who you pay back (school vs private lender).

- Salary Floor – the lowest salary you can make for the payments to be due. If you graduate and make a salary that is less than the floor, you won’t be required to make the payments, until your salary is higher than the “floor” or minimum threshold.

- Payment Cap – the highest amount you’ll be required to pay back. Depending on how much you borrowed, these caps can be anywhere from less than the borrowed amount (<1x), and all the way to twice the borrowed amount (2x). Definitely pay attention to this value, as it’ll impact you greatly in the future and you won’t know what you’re future salary is going to be until you graduate and start working.

- Repayment Term – the period or length of time over which you’ll be making payments.